Experienced Leadership. Enterprise Ready.

The Zenoss management team brings together years of experience and executive leadership in enterprise hardware, software and IT services. These well-seasoned executives foster collaboration, empower teams, and promote a culture that values people and creates customers for life.

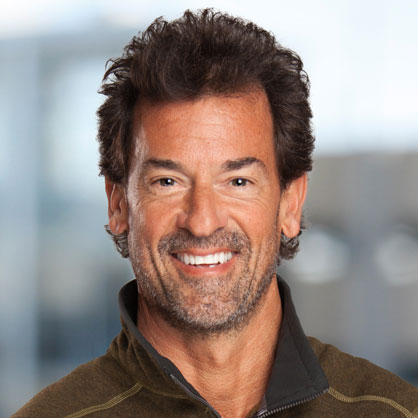

As chairman and CEO of Zenoss, Greg Stock has guided the company to double-digit annual growth and profitability by reinventing a technology, transforming a culture, and igniting the market for hybrid IT monitoring software. Greg's vision is that Zenoss will drive the evolution to software-defined IT operations for the largest companies in the world.

Greg's track record spans more than 20 years of executive leadership with exceptional companies, including Vovici (acquired by Verint), Mirage Networks (acquired by Trustwave), Vastera (IPO), and Manugistics (IPO).

Recent accolades for Greg and his team include: 2017 finalist for the E&Y Entrepreneur of the Year award, 2017 Austin Best Places to Work, and 2016 Forbes Best Places to Work.

Greg holds both an MBA and a bachelor's degree from Penn State University in State College, Pennsylvania.

Pritesh Upadhyay has more than 22 years of experience leading sales organizations for technology providers. He is a subject matter expert in service assurance and infrastructure monitoring/management. He has a passion for working with clients to ensure their success in delivering business results and has a proven track record earning the business of some of the world’s largest companies.

Before joining Zenoss, Pritesh was the chief revenue officer for Optanix, where he ran the global sales and channels organizations. Prior to Optanix, he was vice president of sales for CA Technologies, where he also served in a number of sales leadership roles during his 18 years with the company. While at CA, he was personally selected to drive change and transform the service management and infrastructure business with revenues exceeding $2 billion annually.

Pritesh graduated from Minnesota State University in Mankato, Minnesota, with a bachelor’s degree in computer science.

Trent Fitz is a veteran technology marketing professional with more than 20 years of experience in the high-tech industry. Trent is a proven leader of global marketing, product strategy and business development in technology companies offering solutions in cloud computing, cybersecurity and artificial intelligence.

Prior to joining Zenoss, Trent spent six years as an executive consultant for technology companies around the globe. Prior to that, he held senior management positions at SailPoint, Trustwave and Mirage Networks.

Trent holds a bachelor's degree in computer engineering from the University of Oklahoma in Norman, Oklahoma.

Rama Vykunta joined Zenoss in 2014 and has more than 20 years of experience leading and managing engineering teams in designing, building and operating large-scale SaaS-based and on-prem software systems and solutions. As Chief Technology Officer, Rama oversees the Zenoss global engineering and operations teams and drives the company's technology innovations and flagship product offerings.

Prior to Zenoss, Rama held various leadership roles in large and small organizations that span engineering, architecture and product at IBM brands Tivoli and Websphere, Netheartbeat, and Orillion. At Tivoli, Rama led greenfield development of the application performance management line of products. At Websphere, he led engineering and operations for the PureApplication line of products. Prior to that, he held engineering leadership roles at Nethearbeat and Orillion.

Rama holds both a master's and bachelor's in computer science from universities in the U.S. and India.

Marc Georg has continually guided customers to success over the past 20 years with leadership roles in customer success organizations. As vice president of customer success, Marc has combined responsibility for the customer success and customer support teams that work closely with customers and partners to drive operational excellence and ensure long-term success.

Prior to joining Zenoss, Marc held leadership positions at Troux Technologies (now Planview), Niku Corporation (now CA Technologies), and SAP, supporting a global portfolio of customers.

Marc holds an international management MBA from the Thunderbird School of Global Management in Phoenix, Arizona, and a bachelor's in business administration from Trinity University in San Antonio, Texas.

Mike Nicholas has more than 30 years of experience successfully building and leading teams in the software industry. He has helped launch several startup companies in the Austin technology sector while working with global markets and Fortune 100 customers. As vice president of customer service, Mike manages the professional services group, focusing on ensuring rapid time to value, delivering custom solutions and integrations, and making customer deployments successful.

Mike also heads the Zenoss Cares team, a group focused on giving back to the community through volunteer opportunities for Zenoss employees and families. Opportunities have included Texas parks, Central Texas Food Bank, interactive children's museums, Dress for Success, We Are Blood drives and more.

Blair Duncan has more than 25 years of experience in scaling businesses, building passionate teams, fundraising, strategic planning, and business transactions with high-growth companies. He oversees financial and human resources activities for Zenoss, including accounting, treasury, budgeting, contracts and risk management.

Before Zenoss, Blair served as CFO of Continuant and The Appraisal Lane, with additional previous roles as CFO/COO at Celling Biosciences and CFO at Emergent Technologies, SiteStuff, Trillion and ClearSource. Blair has founded four companies during his career and is still associated with Convergence Ventures, a life-science venture capital fund in Texas. Collectively, he has raised more than $200 million in private equity, another $200 million in credit facilities, and he has acquired or sold 10 companies.

Blair graduated from Duke University in Durham, North Carolina, with a double major in economics and psychology and has an MBA from the University of Texas at Austin with a concentration in entrepreneurship and finance. He is also a certified public accountant (CPA), an active member of Financial Executives International, and was a founding finance committee member at the Long Center for the Performing Arts. He serves as board member and treasurer for the Maya Exploration Center and is a graduate of Leadership Austin, a civic engagement and community leadership program.

Board of Directors

As chairman and CEO of Zenoss, Greg Stock has guided the company to double-digit annual growth and profitability by reinventing a technology, transforming a culture, and igniting the market for hybrid IT monitoring software. Greg's vision is that Zenoss will drive the evolution to software-defined IT operations for the largest companies in the world.

Greg's track record spans more than 20 years of executive leadership with exceptional companies, including Vovici (acquired by Verint), Mirage Networks (acquired by Trustwave), Vastera (IPO), and Manugistics (IPO).

Recent accolades for Greg and his team include: 2017 finalist for the E&Y Entrepreneur of the Year award, 2017 Austin Best Places to Work, and 2016 Forbes Best Places to Work.

Greg holds both an MBA and a bachelor's degree from Penn State University in State College, Pennsylvania.

Taylor Rhodes, Chief Executive Officer, leads Team Applied and is responsible for the company's overall strategy and operational execution. Rhodes joined Applied in 2019 after serving as chief executive officer of SMS Assist, the leading cloud-based software platform for multi-site property management. Previously, he was CEO of Rackspace, where he led the Company’s growth from a cloud pioneer to an industry leader with more than two billion dollars in revenue, while establishing the company as a mainstay on the Fortune 100 Best Companies to Work For®. Prior to Rackspace, he served as a leader in enterprise, financial and corporate strategy roles at Electronic Data Systems Corporation. Mr. Rhodes is a former United States Marine Corps infantry officer and holds a MBA from the University of North Carolina at Chapel Hill. He serves on the board of directors for Applied, Zenoss and Liquid Web, LLC.

Thomas Jennings is a Managing Director with Summit Partners, focusing primarily on the technology and healthcare & life sciences sectors. Based in Summit’s Boston office, Tom joined the firm in 1997 and today co-heads the firm’s venture capital activities in North America, Europe and Asia. He is currently a director of Accedian Networks, ApoCell, AvePoint, PeerApp, Telerik and Zenoss and is actively involved with the firm’s investments in Casa Systems, Hiperos, IMMCO Diagnostics, LogiXML, NameMedia and OB Hospitalist Group. Tom’s prior investments and directorships include Anesthetix Holdings (acquired by TeamHealth), Burst Media Corporation (AIM: BRST, later acquired by blinkx PLC), Commnet Wireless (acquired by Atlantic Tele-Network, Inc.), Fermentas International (acquired by Thermo Fisher Scientific), Hatcher Associates (acquired by Corillian Corporation), NetWitness Corporation (acquired by EMC Corporation), Sage Telecom and Unica Corporation (NASDAQ: UNCA, later acquired by IBM). Prior to Summit, he worked as a consultant with Andersen Consulting (now Accenture).

Tom holds an AB in economics and theology from Boston College, where he received the Scholar of the College award. Tom is a Trustee of the Massachusetts Soldiers Legacy Fund, an organization that provides tuition funding for the children of fallen service members from Massachusetts.

Over his 16 year career as a venture capitalist, Jonathan Perl has focused primarily on early-stage information technology companies. Jonathan’s representative information technology investments include iLumin Software Services, Inc. (sold to Computer Associates), Era Corporation (sold to SRA International), Metron Aviation, Inc. (sold to Airbus), Clarabridge, Inc., Millennium Pharmacy Systems, Inc., Zenoss, Inc., RedCloud Security, Inc. (sold to Avigilon), eMinor, Inc., and TerraGo Technologies, Inc.

Jonathan serves on the boards of Clarabridge, Millennium Pharmacy Systems, Zenoss, eMinor, and TerraGo Technologies, and is a board observer for MediaMath, Inc. He also serves on the board of the Mid-Atlantic Venture Association and co-chaired its flagship event, Capital Connection in 2009 and 2010.

Jonathan is a past Board Member of the North Carolina Council for Entrepreneurial Development, served on the executive committee of the Board of Trustees and was Treasurer of National Child Research Center, a preschool in Washington, DC, from 2008- 2012.

Jonathan holds an MBA from the Amos Tuck School of Business at Dartmouth College (1997) and a BA (magna cum laude) in classical history from Tufts University (1988)

Chuck Cullen joined Grotech Ventures in 2000 and is a General Partner. Chuck serves on several other current portfolio company boards, including Ceterus, Healthcare Interactive, Krista Software and Toluna. He also works closely as a Board observer on Fluid, ThreatX, Webscale and XOi. He previously served on the boards of Biotix (acquired by Mettler Toledo), Brandywine Senior Care (acquired by Warburg Pincus and two public REITs), buySAFE (acquired by EasyPost), Cloud Elements (acquired by UIPath); Dizzion (acquired by LLR); Entek (acquired by DuPont); GutCheck (acquired by Toluna); MEDecision (Nasdaq: MEDE, subsequently acquired by HCSC), Sagittarius Brands (holding company for Captain D’s and Del Taco restaurants), Social Safeguard (secondary sale to Allegis/NightDragon) and WiserTogether (acquired by Evive Health).

Prior to joining Grotech, Chuck served as the Chief Financial and Administrative Officer of Avatech Solutions, Inc., an IT solutions provider serving the design automation market. He previously worked as a management consultant on Fortune 500 engagements for A.T. Kearney, Inc., practiced law with Hogan and Hartson and began his career in public accounting as a CPA with Ernst & Young.

Chuck received a Bachelor of Business Administration degree in Accounting (Magna Cum Laude) from Loyola College. He received his Juris Doctor degree (Magna Cum Laude/Notre Dame Law Review) from the University of Notre Dame Law School and his Master of Business Administration (Beta Gamma Sigma) from the Kellogg Graduate School of Management at Northwestern University. He has served on the advisory board of the Maryland Center for Entrepreneurship and the Tech Commercialization Review Panel at the Johns Hopkins Applied Physics Lab. Chuck has also served as a judge for the Invest Maryland Challenge, Ernst & Young’s Entrepreneur of the Year program and the Maryland Incubator Company of the Year program.

Mitch has primary responsibility for Intersouth Partners' technology portfolio. He joined Intersouth in 1989, shortly after its founding. Mitch has extensive full-cycle venture investment experience and has personally led more than 20 investments for Intersouth.

Prior to joining Intersouth, Mitch served as CFO for a high-growth computer hardware and software company. Previously, he worked as a manager in the high-growth business practice at Deloitte.

Mitch is a former Director and Chairman of the Board of the Council for Entrepreneurial Development. He currently serves on the Board of Directors of the North Carolina Technology Association and the entrepreneurially focused NC Ideafoundation. He is also a member of the Advisory Board of the Center for Entrepreneurship and Innovation at Duke University's Fuqua School of Business. In addition, he has served as a mentor to the Kauffman Foundation’s Kauffman Fellows Program.

Mitch is a frequent speaker on the topic of venture capital and an adjunct professor at the University of North Carolina Kenan-Flagler Business School, where he teaches a course on venture capital. He received an A.B. in management science from Duke University.

Zenoss Investors

Summit Partners

Summit Partners is a growth equity firm that invests in rapidly growing companies. Founded in 1984, Summit has raised nearly $15 billion in capital and provides equity and credit for growth, recapitalizations, and management buyouts. Summit has invested in more than 350 companies globally in the technology, healthcare and other growth industries. These companies have completed more than 125 public offerings, and in excess of 130 have been acquired through strategic mergers and sales. Summit Partners has offices in Boston, Palo Alto, London and Mumbai.

Whether Summit Partners takes a minority or majority ownership position, their approach is the same. They view themselves as a growth investor that provides strategic and operational guidance to help proven, existing management teams reach their companies' full potential.

Grotech Ventures

Founded in 1984, Grotech Ventures is one of the country's leading venture capital and private equity firms with a track record of helping to build successful companies. Grotech is focused on early- and growth-stage information technology investments and later-stage health care and consumer investments. Led by an experienced team of operating and private equity professionals, Grotech seeks investments where the combination of its financial backing, domain expertise, industry relationships, and operating experience will accelerate growth. The partnership manages $1 billion in committed capital from offices in Maryland and Virginia.

Intersouth Partners

Intersouth Partners is one of the most active and experienced early-stage venture funds in the Southeast, having invested in more than 80 private companies over the last twenty years. Founded in 1985, Intersouth manages more than $775 million in seven venture capital limited partnerships, making it the largest venture capital fund in North Carolina and one of the largest in the Southeast.

Based in Durham, North Carolina and Reston, Virginia, Intersouth Partners seeks a broad range of investment opportunities in the information technology and life sciences sectors. Our experienced team has full-cycle experience in the complex matters associated with investing in fledgling companies, including management team development, technology assessment and transfer, corporate partnering and successful exits.

Boulder Ventures

Boulder Ventures, Ltd. identifies exceptional entrepreneurs building market-leading technology companies and provides the funding, contacts and experience needed to succeed in today's highly competitive environment. We are dedicated to helping start-up, early-stage and emerging-growth companies.

The Boulder Ventures' team of professionals has over 100 years of collective experience in building successful businesses. Our portfolio companies have found that the combination of analytical, technical and interpersonal skills possessed by BV investment professionals are valuable resources not only for identifying and evaluating investments, but in assisting companies throughout their life cycle.